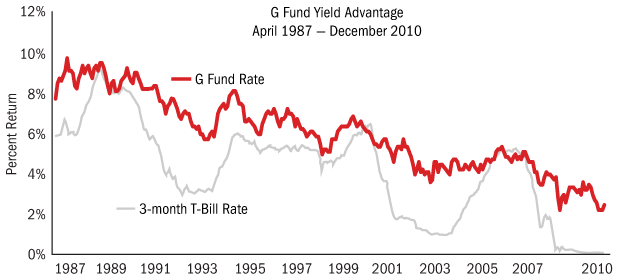

The federal employee option that you don’t have is referred to as the G Fund in the Thrift Savings Plan (TSP). The TSP website describes the G Fund thus.

“Fund principal and

interest is guaranteed by the U.S. Government. This means that the U.S. Government

will always make the required payments. In other words, your G Fund investment

is not subject to credit (default) risk. The G Fund interest rate

calculation is based on the weighted average yield of all outstanding Treasury

notes and bonds with 4 or more years to maturity. As a result, participants who

invest in the G Fund are rewarded with a long-term rate on what is essentially

a short-term security. Generally, long-term interest rates are higher than

short-term rates.”

The one, three, five and ten year

returns for the G Fund, compared to the same timeframe returns for a commercially available government

money market fund, are given in the following table. Note that for the last three years, the G Fund

offered 2.2 percent better annual returns than the money market fund.

G Fund and Money Market Comparison

|

|||

TSP G Fund Annual Return

|

Money Mkt Fund Annual Return

|

G Fund Premium

|

|

10 Year Avg.

|

3.60%

|

1.70%

|

1.90%

|

5 Year Avg.

|

2.70%

|

0.50%

|

2.20%

|

3 Year Avg.

|

2.20%

|

0.01%

|

2.20%

|

One Year (2012)

|

1.50%

|

0.01%

|

1.50%

|

Through 12/31/12, sources:

|

|||

All federal employees whose job puts them into a pension plan can save in the TSP. The TSP is a tax advantaged retirement savings program. At the same time, participants can withdraw money via ridiculously low cost unsecured loans for up to 5 years for any purpose, and up to 15 years to finance the purchase of residential real estate. Approach a loan officer seeking a 1 or 2 percent unsecured loan at your local bank or credit union. Or ask her to secure a loan using a retirement account as collateral. She will laugh. But if you are a federal employee, ask your special banker and she will say, yes sir.

I

retired from the federal government under the Civil Service Retirement System (CSRS)

program, which provides for inflation-protected retirement annuities paying as

much as 80 percent of the average of an employee’s high three earning years. After backing out retirement and Medicare

contributions that are no longer deducted when converting from a work check to

a retirement check, and adjusting for the tax advantages of being retired, CSRS

retirees can walk away from work with essentially no loss in take home pay. So you would not think CSRS annuitants would

need any special help. Yet, over the

last three years my extra G-Fund kick has been worth about $35,000. I am not planning to take a penny out of my

TSP account before the law requires when I turn age 70 and one half. During that eleven years I expect to roll up

another $150,000 or so of risk free interest rate advantage. Over my remaining life expectancy I'll be gaining a quarter of a million dollars.

Yours truly is not an extreme example. My TSP balance is smaller than many employees who were hired post-1984 under the Federal Employee Retirement System (FERS) program. Unlike myself, these more recently hired Feds earn matching TSP employer grants. Also, for many years FERS employees were permitted to contribute higher percentages of their salary to the TSP than CSRS employees. If they are diligent savers, FERS employees can build TSP balances to more than a million dollars, which means they can grow their annual interest income G Fund advantage to about $25,000 by time they retire.

An outsize interest income advantage has persisted from the program's inception and has a large and growing fiscal impact. As of October 2011, the system wide G Fund balance was approximately $150 billion, up by about $25 billion over the previous year. The fund is growing rapidly because of new participants, big federal salaries and external injections; baby boomer participants nearing retirement are taking advantage of the option to roll in IRA accounts and private sector 401(k) account balances they built when they worked for other employers.

Applying the recent 2.2 percent premium, the projected budget impact of the special G Fund benefit will be about $70 billion over the next decade. That’s $70 billion that will be passed to your children and grandchildren, debt they will service again, and again, and again. What we have here is a seemingly small, but poorly understood matter, which like many budget matters that could be managed by a competent executive, has a very large impact.

Obama

has made no commitments to reduce spending in any way, shape or form. He sasses and demeans the messenger when

reductions are proposed. There is no high-profile

process in place in the executive branch (such as the Grace Commission during

the Reagan administration) to identify savings opportunities. So you can pretty much take that $70 billion burden

straight to the US debt bank. But do

not despair. The silver lining for you

taxpaying suckers (I mean patriotic individuals) out there is, if you are

nearing retirement, all you need to do is find a job, most any job, with the

federal government and stay employed for a pay period or two to minimally fund

your TSP. Then retire! Your weeks of federal service entitle you to rollover your lifetime balances from other retirement funds and get on board

the G Fund gravy train! Then stick it to your children. That’s fairness

in the world of Obama. Enjoy!

Obama

has made no commitments to reduce spending in any way, shape or form. He sasses and demeans the messenger when

reductions are proposed. There is no high-profile

process in place in the executive branch (such as the Grace Commission during

the Reagan administration) to identify savings opportunities. So you can pretty much take that $70 billion burden

straight to the US debt bank. But do

not despair. The silver lining for you

taxpaying suckers (I mean patriotic individuals) out there is, if you are

nearing retirement, all you need to do is find a job, most any job, with the

federal government and stay employed for a pay period or two to minimally fund

your TSP. Then retire! Your weeks of federal service entitle you to rollover your lifetime balances from other retirement funds and get on board

the G Fund gravy train! Then stick it to your children. That’s fairness

in the world of Obama. Enjoy!

No comments:

Post a Comment